HELOC A HELOC is often a variable-charge line of credit rating that lets you borrow cash for a established interval and repay them later.

is made that will help you meet your borrowing desires. Proper emergencies could be a vehicle restore, professional medical take care of you or All your family members, or travel bills in reference to your career. This support will not be intended to give an answer for all credit score or other money needs. Alternate sorts of credit rating, such as a bank card cash advance, personalized loan, dwelling fairness line of credit rating, existing price savings or borrowing from a colleague or relative, could be less expensive plus much more suitable for your money wants. Refinancing may very well be out there and isn't automatic. Refinancing will cause more charges.

(5) Payment calculations. For reasons of pinpointing whether The patron's regular payment for a typical home finance loan will probably be materially lower in comparison to the every month payment with the non-typical property finance loan, the subsequent provisions shall be applied:

Individual loans may be used for just about everything, and there are a lot of factors you may want to apply for a person. However, it’s crucial that you choose to only take out an quantity of debt you'll be able to take care of. Many of the most typical motives for personal loans incorporate: Marriage ceremony

Giving a license selection considerably increases your prospect of obtaining a loan. If you don't Have got a driver’s license, you might use a condition or government ID range. Enter Motorists License

Lifetime insurance coverage guideLife insurance coverage ratesLife insurance policies and coverageLife insurance policy quotesLife insurance coverage reviewsBest existence insurance policy companiesLife insurance plan calculator

i. Initially, the payment must be determined by the excellent principal stability as of your day from the recast, assuming all scheduled payments are created beneath the conditions from the authorized obligation in influence prior to the mortgage loan is recast. To get a loan on which only desire and no principal continues to be compensated, the fantastic principal harmony at the time of recast will be the loan sum, as described in § 1026.forty three(b)(5), assuming all scheduled payments are created beneath the phrases in the lawful obligation in impact before the mortgage loan is recast.

A similar Exclusive rule for figuring out the yearly percentage level for such a loan also applies for needs of § 1026.43(b)(4). ii. Loans for which the desire price may perhaps or will adjust. Part 1026.forty three(e)(2)(vi) features a Exclusive rule for identifying the yearly percentage price to get a loan for which the desire level may or will adjust inside the first five years after the date on which the primary standard periodic payment will likely be owing. This rule applies to adjustable-fee mortgages that have a fixed-level duration of 5 years or less and to step-price home loans for which the curiosity price changes inside of that website 5-12 months interval.

Bankrate follows a strict editorial policy, to help you have faith in that we’re Placing your interests to start with. Our award-winning editors and reporters create trustworthy and exact articles to help you make the right economical choices. Crucial Rules

iii. Optimum curiosity rate in the course of the very first five years. For any loan for which the interest level might or will transform within the very first five years once the day on which the first regular periodic payment will probably be due, a creditor need to deal with the most desire amount that would utilize at any time during that 5-calendar year period of time as being the fascination charge for the complete time period of the loan to find out the yearly proportion amount for functions of § 1026.

Your browser isn’t supported any more. Update it to find the ideal YouTube working experience and our latest attributes. Find out more

4. Verification of simultaneous loans. While a credit score report might be accustomed to confirm present obligations, it will likely not reflect a simultaneous loan which has not nonetheless been consummated and may not reflect a loan that has only in the near past been consummated. In case the creditor is aware or has reason to know that there'll be a simultaneous loan extended at or just before consummation, the creditor might confirm the simultaneous loan by obtaining 3rd-party verification from the third-occasion creditor of the simultaneous loan.

The downside of a 401(k) loan? You’re borrowing from your long run self, which lessens your retirement nest egg and its development in a very tax-advantaged account. And when you leave your task prior to the money are repaid, you will have to repay the remaining harmony immediately to stay away from penalties.

Speedy Loan Immediate advises borrowers to understand particular loans, warning that applying for the utmost sum can maximize repayment burdens. The company endorses evaluating repayment capacity and loan requirement to equilibrium instant requires with very long-time period risks, endorsing accountable borrowing.

Andrew Keegan Then & Now!

Andrew Keegan Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Suri Cruise Then & Now!

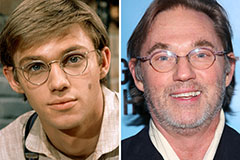

Suri Cruise Then & Now! Richard Thomas Then & Now!

Richard Thomas Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!